2 Which of the Following Is Not a Financing Ratio

What is the most widely used liquidity ratio. Loan-To-Deposit Ratio - LTD.

Observed Financial Ratios Download Table

Financial data may be distorted due to price-level changes.

. Loan to Value Ratio Your loan to value ratio is calculated by the total dollar amount of the loan divided by the appraised value of the collateral. The debt-to-income ratio DTI is a lending ratio that represents a personal finance measure comparing an individuals debt repayments to his or her gross income Gross Income Gross income refers to the total income earned by an individual on a paycheck before taxes and other deductions. The loan-to-deposit ratio LTD is a commonly used statistic for assessing a banks liquidity by dividing the banks total loans by.

Payout ratio is subtracted from one to calculate A Growth ratio B Present value ratio C Retention ratio D Future value ratio Answer. Assume that current assets equal current liabilities Accounts receivable are collected. Which of the following would not be considered a source of financing.

A Current ratio B Inventory turnover ratio. Current Ratio current assets current liabilities. Which of the following ratios would not be classified as an asset management ratio.

It tells you that when divided by its earnings per share EPS or 025 in this case its price 213 equals 85. Do not round intermediate calculations and round your answers to 2 decimal places eg 3216 b. All of these statements are correct.

View Test Prep - chapter 2 from BUSI 1511 at FPT University. Issue long-term debt to buy inventory Because this is the only one which will increase current assets without increasing current liabilities. Calculate the following financial ratios for each year.

A The Debt-Equity ratio of a company is 1. 2 Obtained a short-term loan from bank Rs 100000. Long -term solvency is indicated by _____.

How would payments for taxes be classified. Trends and industry averages are historical in nature. Do not round intermediate calculations and round your answers to 2 decimal places eg 3216 c.

State with reason which of the following transactions would i increase. D Ratios are not predictive. Do not round intermediate calculations and round your answers to 2 decimal places eg 3216 b.

Ii decrease or iii not change the ratio. B From the following information compute Total Assets to Debt Ratio. 1 Issued equity shares of Rs 100000.

It comprises all incomes on a. Changes in balance sheet accounts are necessary for. Financial ratios can be used to compare a firm to its peer firms.

Which of the following is a potential problem of utilizing ratio analysis. All of the above. A clearly is the answer.

Quick Ratio Receivable Turnover Ratio a. Business Finance QA Library Calculate the following financial ratios for each year. This problem has been solved.

A The possibility of accelerating or delaying investment projects. Most lenders will require the appraised value of your collateral to be higher than the loan amount. A financial ratio allows us to consider only one measure in isolation and to be able to draw conclusions about how well the company is being run.

Development of benchmarks B. Both a and b ANSWER. Larger lenders may still make a mortgage loan if your debt-to-income ratio is more than 43 percent even if this prevents it from being a Qualified Mortgage.

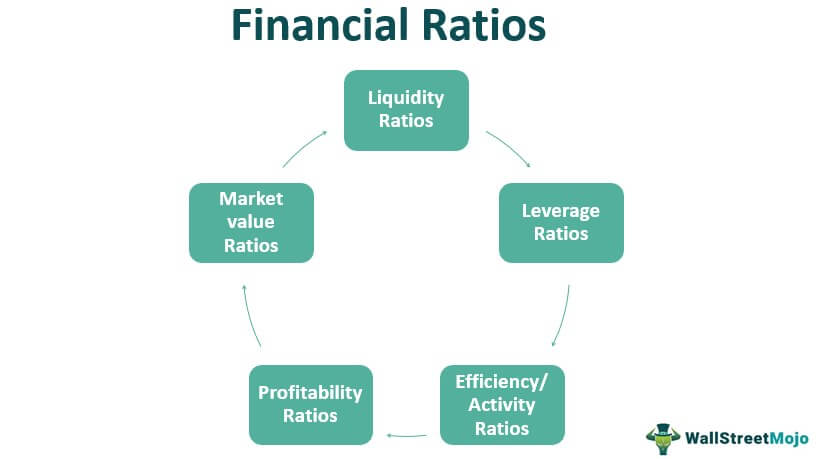

Finance questions and answers. Register now or log in to answer. Below are the types and list of financial ratios with formulas.

But they will have to make a reasonable good-faith effort following the CFPBs rules to determine that you have the ability to. Because all options do improve the finance section except option a. Types of Lending Ratios.

Terms in this set 16 27. Inventory Turnover Ratio Inventory Turnover Ratio Inventory Turnover Ratio measures how fast the company replaces a current batch of inventories and transforms them into sales. Knowing that a share price is 213 doesnt tell you much but knowing that the companys price-to-earnings ratio PE is 85 provides you with more context.

The lender is looking at this ratio to see how much breathing room they have. Return coverage ratio D. Other things held constant which of the following will not affect the quick ratio.

Which of the following is NOT TRUE about using financial ratios. Firms within an industry may not use similar accounting methods. Which of the following would not have an influence on the optimal dividend policy.

Prepaid expense Unearned revenue c. Given the following ratios for four companies which company is least likely to experience problems paying its current liabilities promptly. Debt management ratios evaluate whether a firm is financing its assets with a reasonable amount of debt versus equity financing.

Do not round intermediate calculations and round your answers to 2 decimal places eg 3216. Which of the following isare the problems encountered in financial statement analysis.

Types Of Financial Ratios Step By Step Guide With Examples

Financial Ratios Calculations Accountingcoach

List Of Financial Ratios Advantages Disadvantage Types Of Ratios

No comments for "2 Which of the Following Is Not a Financing Ratio"

Post a Comment